Image Attribution: Alpha Stock Images – http://alphastockimages.com/

I have been on a tear on social media channels and more specifically on my Google/Opentable reviews when it comes to merchants and restaurants incorrectly using of so-called convenience fees. The problem lately is everyone is starting to do it because they THINK it’s actually solving some new sort of problem for them. In fact I am going to try and explain why this isn’t the case and in fact how this is just hurting their own reputations. Also what I am finding is many merchants do not even understand how these are supposed to be used and the rules around them. I feel as though more people need to educate themselves better than the merchants and call these things out or even start filing the merchants with the state Attorney General’s offices. Hopefully I am able to convince you to ask more questions and at the same time convince some merchants to just stop the practice. For the record STK Promotions has never bought into this practice and never will, nor any other business we run. In fact I am friends with merchants that live on both sides of this fence.

What Are Merchants Paying For Processing?

These are the fees charged to a seller to run your credit card. Understand this includes things like security costs, PCI Compliance costs by the processor, and a host of other things that is meant to help the merchant securely run your card. These fees have been charged to merchants for DECADES. This is not anything new. My dad was paying these fees back in the 90’s when he had a store. People seem to think this is an all new practice, when it’s not. So what are these processing fees like? Below I have built a small table just of the most common public processing fees. You can see these are pretty much in line.

| Processor | Tap/Swipe Processing Fee | Online Processing Fee | Manual (Keyed) Processing Fee |

|---|---|---|---|

| Square | 2.6% + .$10 per transaction | 2.9% + .$30 per transaction | 3.5% + .$15 per transaction |

| PayPal | 3.49% + .$49 per transaction | 3.49% + .$49 per transaction | 3.49% + .$49 per transaction |

| Toast | 1.8% + $.15 Per Transaction | 1.8% + $.15 + .$99 Per Transaction | ?? |

| Clover | 2.6% + $.10 Per Transaction or 2.3% + $.10 Per Transaction | 3.5% + $.10 Per Transaction | ?? |

What you also have to realize is all these processing fees are usually negotiable based on the merchants level of transactions too. These are just the basic published rates, but even square will give a lower rate once you do $250k a year in transactions. Yes these processing fees are different if the card is swiped, keyed, or used online simply because the security of those is considered different. Online anyone can be running your card and the cost of charge reversals also becomes a factor. Remember, what the merchant is getting for the processing fees is a SERVICE to them….just like electricity. They are paying for all the things to securely, and safely run run your card, don’t forget that.

Finally bear in mind almost. all of these companies above also charge the merchant a monthly fee to access their platform, however they have become. so overly focussed on the processing fees because that one fee is legal to surcharge.

Merchants Have All Kinds of Expenses

It should be no secret to anyone that every business has expenses. The list can be long and messy, but it costs money to operate a business. This is just a small list but in context it is important

- Rent/Lease

- Utilities (Gas/Electric/Etc)

- Cleaning Services

- COGS (Cost of goods sold)

- Marketing/Advertising

- Security System Monitoring

- Monthly POS Platform Fee

- CREDIT CARD PROCESSING Service

Yes I have put credit card processing in the list of operational expenses, because that is exactly what it is. Every accountant I have ever talked to has said the same thing. The cost of the credit card processing service is NO DIFFERENT than the service for power, gas, marketing or any other cost of doing business.

Now, what you need to understand before we go forward, is this is exactly how the merchant is putting those processing fees on their books. As a Merchant Fee under the expense column. Yes some like me do it as a monthly expense, others track it per transaction, but it’s no different. The processing fee is an expense paid for a service provided. This is so very important for the next section, because at this point the’ve already written the expense on their books….and now they are are going to make you pay more, thus also increasing their revenue line.

Why Are Merchants Adding Additional Fees?

This is so simple it is stupid. They are trying to get you to SPECIFICALLY pay for the business expense on that ONE credit processing service. Somehow, somewhere, someone decided to treat this service differently than EVERY OTHER operating expense. What’s even more messed up, is the credit card processing companies have SUPPORTED this (for a really good reason), and it’s been allowed to happen! A few states have made it illegal as well and here is why.

First, why has this one service been separated out as “okay” to add extra cost to the consumer for when you price your goods to be sold to cover your expenses and make money. I will tell you why, and it’s why the processors love it, and even this article makes the similar point when discussing why it is a bad practice. In fact it’s GOOD FOR THEM! They MAKE MORE MONEY! It’s really simple math folks. It you have $100 charge the merchant is paying the processing fee after the fact. When they add 3% to your $100 charge, the processing fee is now on $103 vs the $100.

Also bear in mind, that you may most likely pay sales tax on the $103 instead of the $100. I can’t confirm this exactly, but I am going to start paying attention on how the fees/taxes are rolled up now. It will depend on how the system applies the surcharge before or after tax, and many other factors. At the end of the day YOU are getting hit with all these just so the merchant can get ONE of their many business expenses covered so “specifically”.

The credit card processing company just made more money at your expense! The merchant is trying to cover this one specific cost of doing business, but in turn actually given the processor more money. So yeah, they are ALL about supporting this. Square actually advocates against this in one of their forums, especially since there is a push to move to a cashless society around the world.

Hopefully by this point you are already asking yourself how this has become okay by the merchants. Well sadly, it’s legal to do. in most states. Now let’s talk about the rules about how a merchant it supposed to use these correctly. This may draw the final line for you to be like me and start calling them out on how many are doing it wrong.

What Defines a Convenience Fee or a Surcharge?

This is where is all has to start. These are actually NOT the same thing. The merchant agreement documents are very specific around these. For much of this part conversation I will reference a couple articles that explain these very well.

NerdWallet does an awesome job of explaining this but here is the excerpt and read it closely.

A convenience fee is a fee that a merchant charges a customer for paying in a manner that’s not standard for the business (for example, by mail or over the phone with a credit card). A convenience fee is technically different from other charges a business owner could impose, such as a service fee or surcharge

https://www.nerdwallet.com/article/small-business/convenience-fee

- A service fee is a convenience fee that’s only for certain types of education and government merchants.

- A credit card surcharge (sometimes called a checkout fee) is a fee to cover credit card fees associated with a transaction.

So, now that we have defined the difference some more things become important about these different fees. The reason is the second bullet. Simply put the merchant is trying to cover their credit card processing fees associated with the transaction. This is by far the most common use by the merchant. They are not even thinking about the pay by mail or via phone, they have become so foccussed on “Covering that processing fee expenses”

Convenience Fee vs Surcharge

Once again I will paraphrase from the same Nerdwallet link and this is where you really have to pay attention.

In the United States, credit card convenience fees are legal. But they have to be a flat fee (say, $2 per transaction) rather than a percentage of the transaction amount (such as 2% of the total). Also Merchants can’t charge a convenience fee solely because the customer is using a card.

Also If you only sell online, you can’t charge a convenience fee. Convenience fees are for merchants that have multiple payment channels.

https://www.nerdwallet.com/article/small-business/convenience-fee

Oh heaven this is so important! So first thing you can challenge a merchant on is semantics. If they are calling it a “Convenience Fee” and it’s 3%, that’s not correct. They have to charge as stated, a flat fee and this is NOT the “correct” verbiage and in fact this is not the correct use of this fee. So you can challenge this if it’s specifically listed as “convenience fee”. Now a surcharge is what they “should/can” be charging.

A credit card surcharge is a fee paid by a customer who chooses to use a credit card to purchase a good or service. A business adds this extra charge to the advertised price to help cover the cost of credit card processing fees.

https://www.nerdwallet.com/article/small-business/credit-card-surcharges

This is what you commonly see and is most times Mis-Labeled as a Convenience fee. This can be a percentage. However, there are RULES about how this is done that most merchants simply ignore. The most common one ignored I have seen is how/where the notice of the surcharge must appear.

https://www.nerdwallet.com/article/small-business/credit-card-surcharges

- Merchants must give 30 days’ written notice to the card network and payment processor before initiating surcharges.

- A surcharge can’t be applied to purchases made with debit or prepaid cards.

- The surcharge fee can’t be more than the cost of processing the credit card and is capped at 3% of the purchase price for Visa cards and 4% for Mastercard.

- Notice of the surcharge must be given at the entrance of the business and at the point of sale. For online transactions, the surcharge notice must appear on the business’s website where the card brand is mentioned.

- The surcharge dollar amount must appear on the receipt.

Wow, so let’s think about those 5 rules and ask yourself how often you saw this done, or start looking more closely. Bullet number 3 is great because YOU do not know their processing fees, but you can guess. If they are a square shop that’s easy it’s in the table above.

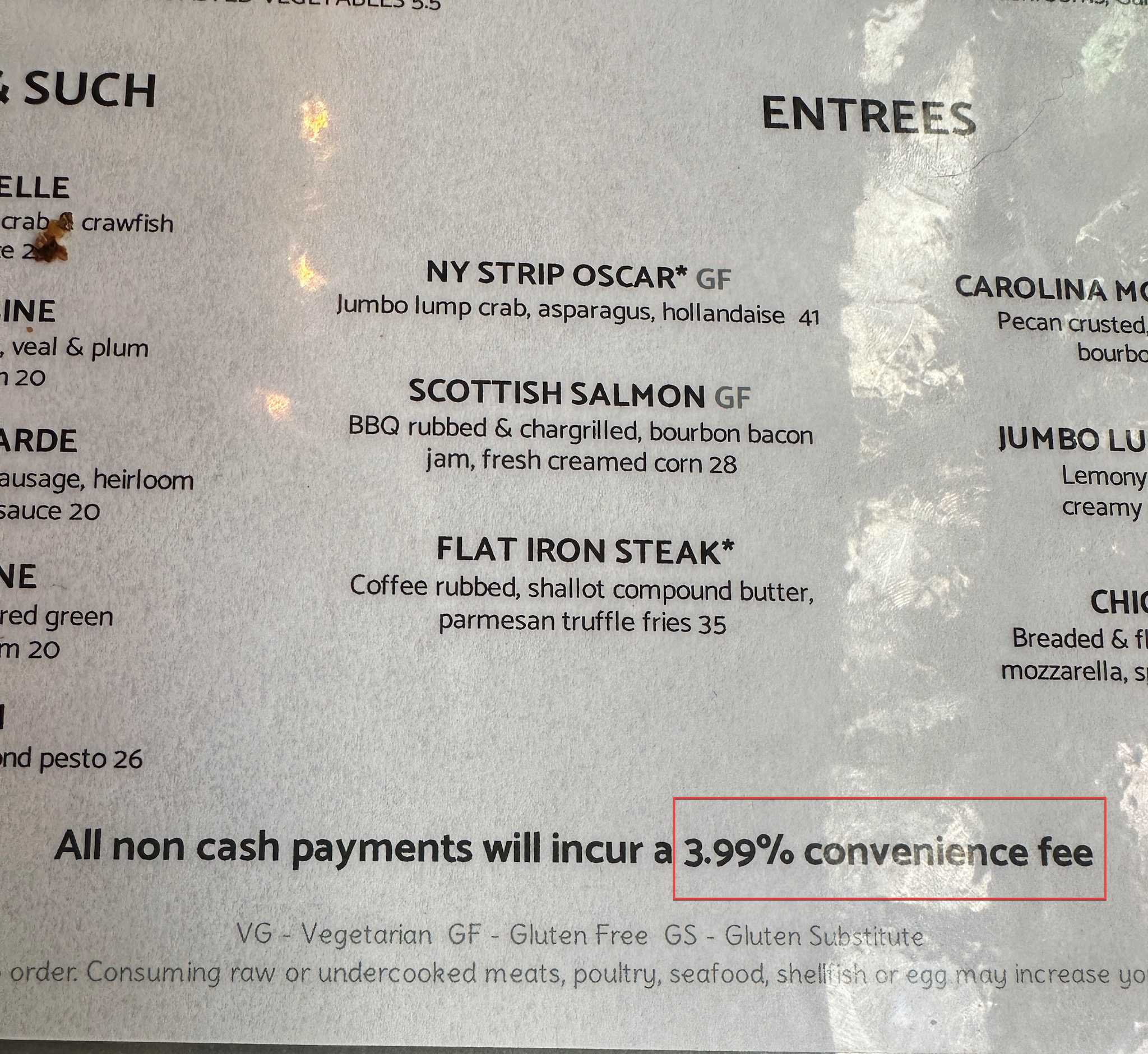

If they are others, it’s not easy to find but you can guess it’s close to or even less that Square or Paypal. Yet what do most merchants do? Slap a flat 3% on the surcharge even if they are paying less than that. I even had a 3.99% recently to stay under that 4% limit. Notice they also incorrectly define this as a convenience fee instead of correctly as a surcharge which as already shown cannot be a percentage. In these cases words actually matter to the rules.

The other item is bullet number 4. I can probably count on one hand the number of places that list the surcharge on the door or entrance. If you are lucky it’s on the menu in a restaurant, and most times you see it only on the receipt after you’ve eaten or paid.

Some Conclusions For You the Consumer

Even Nerdwallet states:

Although the 2013 settlement allows merchants to legally assess surcharges for credit card use in most states, the card networks strongly discourage it. Visa views surcharging as a practice that penalizes cardholders and even quietly sends out auditors to identify merchants who are surcharging in a noncompliant manner. Those merchants are subject to a hefty fine.

https://www.nerdwallet.com/article/small-business/credit-card-surcharges

Even the card issuers don’t recommend the practice. Sadly, all it takes is anyone and everyone doing business reviews to 1-Star the hell out of merchants for these practices and maybe they will realize it’s hurting them in the long run. In fact I did that and I have had a merchant tell me I was out of line with a 1-star review. I replied which many of the rules and citations here. Once you call them out on it….they know you know more than they do. They even told me their processing fees were above 4% to which I replied “you need to negotiate a better rate then”.

A note on the cash discount route too. Merchants may offer a cash discount for not using a card, but let’s face it that’s in a way the same thing. To me it’s not much different other than you are getting around the legal requirement to disclose a surcharge. It’s semantics, but the bottom line is you are paying more if you use a card. This sort of loophole is used quite a bit because cash discounts are legal everywhere and surcharges are in fact illegal in some states. Show me how it’s not the same pig with different lipstick though?

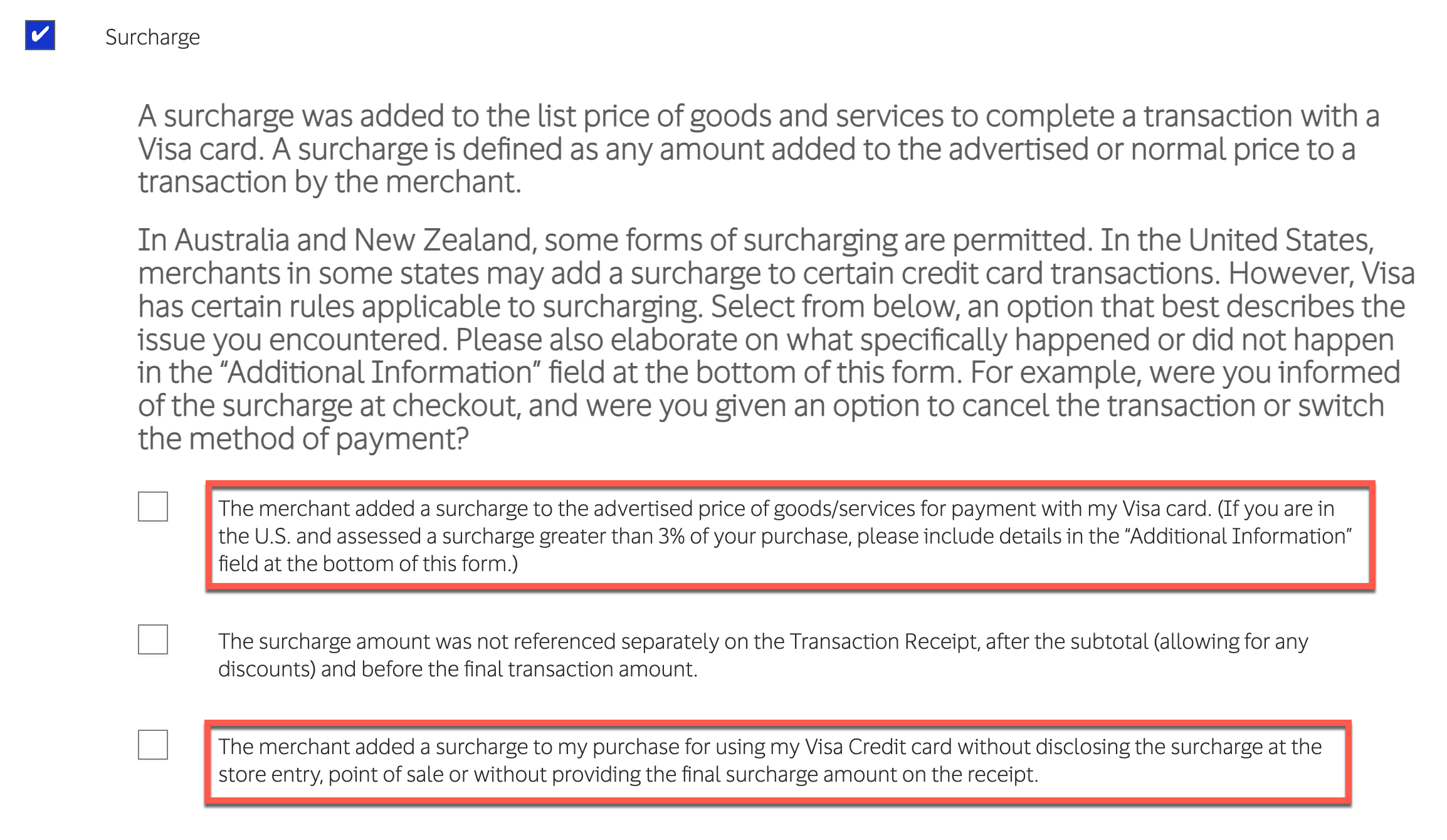

If you choose to go further there is an article about how to report these, but it’s different for each (VISA/MC/AMEX). It does also have some other suggestions. I will say I am mostly a VISA user and their form is amazingly easy to use and even adds the checkboxes for the specific items about charges over 3% and posting the surcharge at the entrance to the business.

Remember VISA and MasterCard have DIFFERENT rules on the level of surcharge, but most merchants doing this add a flat percentage that covers them all, and that isn’t exactly by the rules. Yes I did use this to file that 3.99% The Twisted Laurel in Asheville, NC added because I paid with visa, and 3.99% exceeds the surcharge limit. for VISA, they did not have the surcharges posted on the entrance, and this is most likely well over what they are paying for processing fees. So they violated at least three rules.

The bottom line is educated yourself more than them, ask the questions, see if they are following the rules, and review/report them to the state offices. For sure know the difference in the terminology too, because I can tell you, they don’t. I would hate to see a small business get in trouble, but the problem is easily avoided by NOT accepting this awful business practice.

A Note To Merchants That Continue This

First don’t get mad at me for trying to educate the consumer. Second, I implore you to reconsider this and just accept these as a cost of doing business like all your other expenses. In addition, read the multiple articles like this one about how it really is bad for your business in the long run. Third, think about the biggest merchants out there (Amazon, Marriott, Grocery Stores, Verizon, etc), none of them adopt this practice and they are paying way more than you in processing fees yearly. So why should a small business do something even the biggest of the big are not doing?

Finally, You do you, but if you want to adopt this practice, at least know and play by the rules and I have no issue with you. What I mean is, at least focus on the most important ones that I have taken the biggest issue with and at least play things above board so someone like me can’t even call you out on it.

- Use the right terminology, it’s a surcharge not a convenience fee, they are very different

- Clearly state the surcharge everywhere you are supposed to including the business entrance

- Keep the surcharge to exactly what your processing fees are and no more

Other References

Once again remember every credit card issuer actually has different rules, so in order to properly comply if a merchant accepts all cards, there is a lot more they need to understand before tacking on that 3%. The point for a merchant is this is actually a complicated thing to comply with if you really want to do it. To me, frankly it’s too much work to “do it right” than to not do it at all.

- How Surcharges can Kill Your Business

- Visa Rules and Policies

- Visa Merchant Surcharge Suggestions

- Mastercard Rules for Merchants

- Section 5.12 (Surcharges)

- American Express Merchant Reference Guide

- There is NO reference to Surcharging

- Must Know Surcharge Rules to Protect Your Business

Chris Colotti's Blog Thoughts and Theories About…

Chris Colotti's Blog Thoughts and Theories About…